estate tax exemption 2022 married couple

It is portable between spouses. The federal estate tax exemption is 1170 million in 2021 going up to 1206 million in 2022.

New York Estate Tax Everything You Need To Know Smartasset

Compare this to the 2022 exemption of 1206 million Federal Estate Gift Tax Rates.

. This means that an individual can. The exemption can be applied against any gift tax that would otherwise be applicable to gifts made during life. The exemptions addressed here went into effect Jan.

This means that if you pass away in 2022 and your estate is valued at this amount or more it will be subject to taxes. A married couple can pass. Due to inflation the estate tax exemption has risen this year to 126 million dollars.

Further the annual amount that one may give to a spouse who is not. The History of the Estate Tax Rate. 2022 annual gift tax exclusion.

Gift-splitting allows a married couple or one of them to gift twice as much as an individual without being subject to a gift tax. After four years of being at 15000 the exclusion will be 16000 per recipient for 2022the highest exclusion amount ever. Disability to a property tax reduction up to 1250 for married couples and 1000 for individuals.

This means that by taking certain legal steps a couple can protect up to 2412 million from estate taxes. 12060000 The amount a person can pass on to their heirs which is exempt from estate taxes. The Minnesota estate tax rate is 13-16 and assessed on the value of an individuals estate over the exemption.

Estate Tax Exemption. However the law has a sunset provision. For 2022 the annual gift tax exclusion has increased to 16000.

For the 2022 tax year the annual gift exclusion is 32000 for a couple or for a married individual using gift-splitting. Before January 1 2022 that amount was 11700000. For married couples thats a combined 24120000.

This means that a married couple will have 2412 million of available exemption up from 234 million in 2021. The estate and gift tax exemption is 117 million per person in 2021. A married couple has a combined exemption for 2022 of 2412 million 234 million for 2021.

The exclusion amount is for 2022 is 1206 million. As of January 1 2022 the federal lifetime gift estate and GST estate tax exemption amount will increase to 1206 million up from 1170 million in 2021. The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021.

For 2021 the exemption amount was set at 117 million dollars for individuals and double that amount for married couples. To make a portability election a federal estate tax return must be timely filed by the executor of the deceased spouses estate. This means a married couple can use the full 2412 million exemption before any federal estate tax would be owed.

This amount doubles for married couples. On the federal level the estate tax exemption is portable between spouses. The estate tax is effectively a tax on dying where the Federal Government takes up to 37 of the value of the estate everything owned by the deceased.

During the past 10 years the federal estate tax has not been a major concern for most family financial planners because of the high lifetime exemption 1206 million for individuals and 2412 million for married couples in. As of January 1 2022 that amount is 12060000. Also a husband and.

The new tax law passed in 2017 doubled the lifetime unified estate tax and gift tax exemption. The federal estate tax exemption is 11580000 per individual for 2020 and the federal estate tax rate is high at 40. Unless there is another change in the law this will.

There is something called portability at the federal level and a married couple can combine their estate. In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021. The federal estate tax exemption rate slightly increased from 2021 when it was 11580000 per person and 23160000 for a married couple.

When the second spouse of a married couple dies only one exemption applies. This article discusses some strategies that married taxpayers can use to manage their estate tax liability by creating certain types of trusts. This means that individuals in 2022 can now give others up to 16000 free of gift taxes.

Key Takeaways The federal estate tax exemption for 2022 is 1206 million. In 2022 an individual can leave 1206 million to heirs and pay no federal estate or gift tax while a married couple can shield 2412 million. Fortunately the estate tax credit creates an amount you can pass on to.

This estate tax benefit is known as the estate tax exemption Bolstered by inflationary increases since 2011 now in 2016 each spouse has an estate tax exemption of 5450000. This exemption is portable between spouses. The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025.

The new 2022 Estate Tax Rate will be effective for the estate of decedents who passed away after December 31 2020. This means a couple can protect up to 2412 million with. There is a federal estate tax that may apply on top of the Connecticut estate tax but it has a higher exemption level of 1206 million in 2022.

This increase means that a married couple can shield a total of 2412 million without having to pay any federal estate or gift tax. Dobbs notes that upon a farmers death up to 1206 million can be passed on exempt from federal estate tax. This means that an individual can leave 1206 million and a married couple can leave 2412 million dollars to their heirs or beneficiaries without paying any federal estate tax.

This means that with the right legal steps a married couples estate exemption can be doubled when the second spouse dies. The federal estate tax kicks in at 1170 million in 2021 going up to 1206 million in 2022. To qualify an applicant must 1 be age 65 or older have a spouse age 65 or older or be at least age 50 and a surviving spouse of someone who at the time of his or her death was eligible for the.

In 2026 the federal estate tax exemption is scheduled to decrease to 56 million with inflationary adjustments. The lifetime unified gift estate tax exemption limits the amount you can give away in life or at death without having to pay an estate tax.

California Estate Tax Everything You Need To Know Smartasset

Colorado Estate Tax Everything You Need To Know Smartasset

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Missouri Estate Tax Everything You Need To Know Smartasset

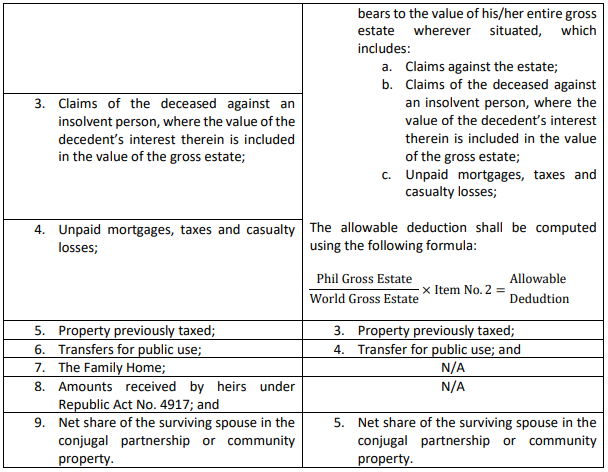

The Unspoken Cost Of Dying A Summary Of Philippine Taxes After Life Lexology

It May Be Time To Start Worrying About The Estate Tax The New York Times

Pennsylvania Estate Tax Everything You Need To Know Smartasset

Wisconsin Estate Tax Everything You Need To Know Smartasset

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Pennsylvania Estate Tax Everything You Need To Know Smartasset

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free In 2022 Money Gift Gifts Cash Gift

/There-Are-Disadvantages-To-Using-Trust-Funds-57073c733df78c7d9e9f6f05.jpg)

Estate Tax Exemption 2022 Definition

New York Estate Tax Everything You Need To Know Smartasset

California Estate Tax Everything You Need To Know Smartasset

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel